What if you could finally escape your debt and start saving money? Continue reading to learn how you can take control of your finances.

A few months ago, I was like so many… I had no savings in my account whatsoever. Then over a span of just a few weeks, I followed this incredible plan and now have thousands in savings.

A few months ago, I was like so many… I had no savings in my account whatsoever. Then over a span of just a few weeks, I followed this incredible plan and now have thousands in savings.I didn’t change my job. And I definitely didn’t have time for a second job. Instead, I focused a few minutes each day on changing my finances – making sure that I never put in more than 20 minutes of effort in a day.

But I’m not here to preach. Instead I’m hoping that by telling you how I changed my finances, I can help you break the paycheck to paycheck cycle too…let's get started:

1. Take Advantage Of Cash Back Rewards

The first thing I did to jumpstart my savings was signing up for Fidelity’s new 2% cash back rewards card. Unlike other cards that only pay for gas and groceries, the 2% applies to any purchase you make...all with no fees. You can then redeem your cash rewards into an eligible Fidelity account and start saving it!

I usually spend about $500-$1000/month between groceries and home essentials for the family, so this helped me save an extra $100-200 a year.

One thing to keep in mind, is that you will need excellent credit to be approved. But for those with less than stellar credit, don’t worry just yet, there are some other great cash back options for you that I'll get to later.

Stop throwing money down the drain - this takes less than 5 minutes, so once you've completed it (or if you don't have excellent credit) feel free to move on to the rest.

2. Get Paid To Watch Fun Videos & Take Surveys

The next thing I did was sign up for Inbox Dollars, which pays you to watch fun videos & take surveys....they'll also give you a $5 free bonus just to give it a try.

By spending just 5-10 minutes per day on this (either on my lunch break or during TV commercial breaks) I was able to earn an extra $50/month.

If making money in your idle time seems like a good fit for you, you should also sign-up for Springboard, MySurvey, Ipsos, and HarrisPoll. They are all pretty similar to Inbox Dollars and also offer some great sign-up bonuses.

The key here is to try and check all of these 1 time per week each, because there are usually a few weekly surveys/promotions on each that will give you the most the most bang for your buck.

Signing-up for these takes about 20-30 seconds each (be sure to check your email after to claim your sign-up bonuses) and could easily result in saving an extra $500-$1000/year.

Save an Extra $500 a Year By:

3. Save 75% on Car Insurance By Comparing Rates

Yes, I know you already know this… But, what you may not know is that car insurance companies make all of their money off of people that have been with them the longest. Don’t believe me? Have you had a clean driving record? Have your premiums stayed the same or even gone up over the past few years?

They think you won’t leave once you’re with them, so they charge whatever premium they want. Personally I used Quotewizard to compare rates and switched from Geico to AllState, but insurers charge different premiums for every state, you can click here to compare the best offers in your state.

4. Stop Paying High Interest Rates On Credit Card Debt

When I decided to get serious about saving money, I had about $2,000 in credit card debt. My old card had an 18% or so APR, so I was paying almost $400/year in interest alone.

I was able to cut this unnecessary expense completely by signing up for Chase Slate®. Chase Slate® is a balance transfer card, which means you can transfer your current debt from any type of credit card (all with no fees), and pay 0% interest for 15 months on your current debt amount. With no interest for 15 months, I'm now steadily paying down my balance with my savings from all the other steps, which will save me $400/year in interest payments alone.

For those with decent credit that have higher debt amounts that will need more than 15 months to pay it off, LendingTree can help you save thousands in the long run by refinancing your debt at rates as low as 5.99%. It only takes a few minutes to see how much you can save, and it's 100% free to give it a try.

And if you're credit isn't great or need some special help, then check out Curadebt - they have a team of professionals who can analyze your finances and help provide expert relief no matter what your situation. And right now they're currently offering MyFinance readers a 100% free consultation. All you have to do is sign up.

If you don’t know your current credit score, you can check it for free in seconds here.

Total Savings: $400 Per Year

5. Sign-Up For Free Coupons

Hunting for coupons in the mail and newspaper can be very time consuming, so I thought why can't I see if there are smarter ways for me to save when I'm shopping?

Turns out, there are plenty of online coupon deals that help you save money and give you great recipe ideas too! Here are some of my favorites:

1. Tablespoon: Sign up for Tablespoon’s free email and score up to $250 per year in coupon savings. Plus, stay on top of your food game with free recipes for doable dinners, delish desserts, party snacks and more!

2. Betty Crocker: Betty Crocker’s FREE email delivers the best of Betty's 15,000 kitchen-tested recipes, how-tos and more - straight to your inbox! PLUS, get up to $250 per year in coupons savings and access to FREE samples (quantities limited, one per member).

3. Pillsbury: Sign up for Pillsbury.com emails to receive up to $250 in yearly coupons, access to free product samples (quantities limited, one per member) and the easiest recipes sent right to your inbox.

Note: General Mills has sponsored the placement of Betty Crocker, Tablespoon, and Pillsbury in this post. This helps us bring you more ways to save!

4. Check out Thrive: They offer exclusive discounts on healthy food options, in most cases up to 50% off! Even better, they currently have a $1K shopping spree sweepstakes, which is totally free, and takes about 2 seconds to sign up for! Check it out here.Total Savings: $750+ Per Year

6. Get Paid To Download Apps

I always loved my social network and game apps, but I never knew there were apps that could make/save me money!

Here are 4 of my favorites that I use:

1. Acorns: Every time you make a purchase, Acorns rounds up the spare change and saves it in a special account - I barely noticed the random change going out, but after 3 months I had over $300 in my account! It's also 100% free to sign up.

2. Give Ebates A Try to get access to over 10,000 coupons to more than 1,800 stores, including places like Walmart and Target where I was already shopping all the time. You can through their deals - I'm easily saving an extra $100-$200 a month and rarely pay full price for anything. Get $10 free just for signing up now now.

3. Paribus: Many retailers offer rebates if the price of an item has dropped shortly after you bought it, but who has time to check? Well Paribus does this automatically for you, and saved me about $20-30/month! Learn more here about how it works.

4. Nielson Digital Voice: You've probably heard of Nielsen before, they provide engagement statistics on TV shows, well this is like that, but for your smartphone. All you have to do is download the app and they'll pay you $50 a year!

Total Savings - $100 Per Month

7. Get $150 Free With Chase Freedom ®

As I mentioned earlier in the article, if you only have good/fair credit, there are still some great options out there to take advantage of cash back rewards on your spending.

For those with good credit, check out Chase Freedom® - you'll get a free $150 just for signing up, and then earn 5% back on different types of purchases (like Walmart, Target, and Grocery Stores) and 1.5% on all other categories - all with no annual fees!

If you know your credit score is lower than 600, you'll need to go with the $100 sign-up bonus and 1.5% back on purchases from the Capital One Quicksilver® Cash Rewards Card instead.

Total Savings: $750 Per Year

8. Drive With Uber in Your Free Time

The next thing I did was register to drive with Uber - if you have a car, it's a perfect way to make a little extra cash whenever it's convenient for you. You might be saying to yourself, "hey you said you didn't get a second job", and technically I suppose you're right, but here's why I didn't see it as a second job, I think you'll agree:

Once you're a driver you can choose to turn the app on or off and drive whenever you have a few minutes to spare. They also have a great feature that allows you to select your destination, so what I would do is turn the app on as I was leaving work (or any other long commute), and pick up a ride that was going in the same direction. I did this 3-4 times a week on my hour commute, and was making up to $275 each month!

While this was some nice extra income for me, I've also heard stories of people increasing their income by 2-3x by driving full-time, according to Uber the national average recently was around $17.20/hour...not bad, right?

9. Save $1000's By Refinancing Your Home

If you own a home and haven't yet taken advantage of the historically low refinance rates, you're probably spending way more than you should be on your mortgage.

LendingTree could help you refinance your mortgage at a significantly lower interest rate - I was able to lower my rate by around 1%, which on my $200K mortgage, saved me over $100/month and over $40,000 in total over the course of my loan! You can use these free calculator to see how much you could save!

Calculate your savings

Current Loan Term (Fixed Rate):

Monthly Payment

Total Loan Amount

Current Loan

$1,297

$466,991

New Loan

$804

$289,377

Potential Savings

$493

Per Month$177,613

In InterestAnd just like with car insurance, it's a good idea to compare your current home insurance prices to make sure you aren't being taken advantage of by the insurance company. Liberty Mutual is offering a 10% discount for those that bundle their home & auto insurance, so getting a free quote from them is a good way to quickly see if you are overpaying.

10. Get Rid Of Cable With Amazon TV

Get rid of cable with a 30 day free trial to Amazon Prime. This may sound crazy, but most families spend over $1,000 every year just on cable. You can save big by switching over to Amazon Prime.

Amazon Prime includes Amazon TV, which has over 17,000 movies and TV shows you can stream whenever you want, all for just $99 a year. I was blown away when I realized how much Amazon had for me to watch. Plus, you'll also get free 2 day shipping from Amazon, which helped me save a ton of time.

Trust me, I was a bit skeptical of giving up normal TV too, but with the free trial, you have nothing to lose by giving it a try. Just don't forget to cancel before your trial is up if you decide you want to keep your cable! Cutting cable saved me almost $1000 a year. Not bad!

11. Invest Your New Savings

Once you have some money saved up, you’ll want to start putting your money to work for you by investing. Nobody makes it easier to start investing than Motif, and right now they are offering a special bonus to sign up.

Here’s how it works: Let’s say you believe that technology is going to continue to change the way we live our lives and you’d love to invest in big-name tech companies. Not a bad idea right?

Ok, so do you buy Google? Or what about Apple? Or Tesla? Amazon? You get the picture, it’s not easy to pick.

This is exactly the problem that Motif solves. With Motif you buy groups of stocks based on a common theme, called a Motif (hence the name).

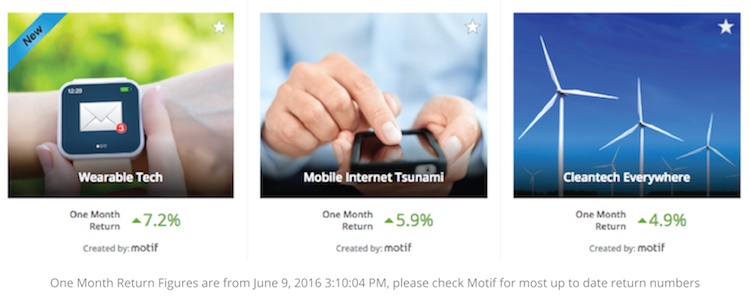

Here are some popular examples:

As you can see, if you would have invested $1000 in Wearable Tech a month ago, you would have earned $72 in interest alone. However, Motif does charge $9.95 per trade, so you’ll need to factor that in.

There are hundreds of Motif’s available, with varying risk levels, so you can pick what makes the most sense for you.

To get started, set up your account and purchase your first Motif. Making that crucial first step is a powerful way to commit to changing your habits!

It takes less than five minutes, and can easily be done from your laptop or mobile phone.

Keep This Going...

If you’ve done everything that I did, and didn’t spend the extra money, in a few months or so you should have saved and earned a total of at least $1,000. $1,000 is great, but what’s better? $5,000. You’re really not that far away if you can keep this going.I've always been super competitive, so I made a game out of trying to save more and more each month, and even challenged my family and friends to see who could save the most. Click the share button below to see if any of your friends/family want to do the same!

Get Started Today!

There is no timeline here because ultimately the quicker you perform all of these, the more you’ll save this year. I don’t know about you, but every day stressing about finances was a wasted day.One final thing I’ve learned: The biggest mistake I made for years was never really getting started. So don't let that happen to you... Take the following steps listed below and get started today!

0 Comments